Informal collaborative saving and lending is common amongst African and Caribbean communities at home and abroad, and in many other communities worldwide. But what is it all about?

Rotating Savings And Credit

There are several reasons why people use informal financial methods. Whether the need is to overcome short or long term financial hurdles, or perhaps they do not have access to ready cash or low cost credit. From the unbanked, to those who simply prefer to leverage their own network of friends, family or community, the most popular types of informal financial collaborations in the world are known as Rotating Savings & Credit Associations (or ROSCAs). This method has many local names such as pardna (Jamaica), susu (Ghana, Caribbean), likelemba (Congo), cundina (Mexico), tanda (Latin America), committee (India) etc.

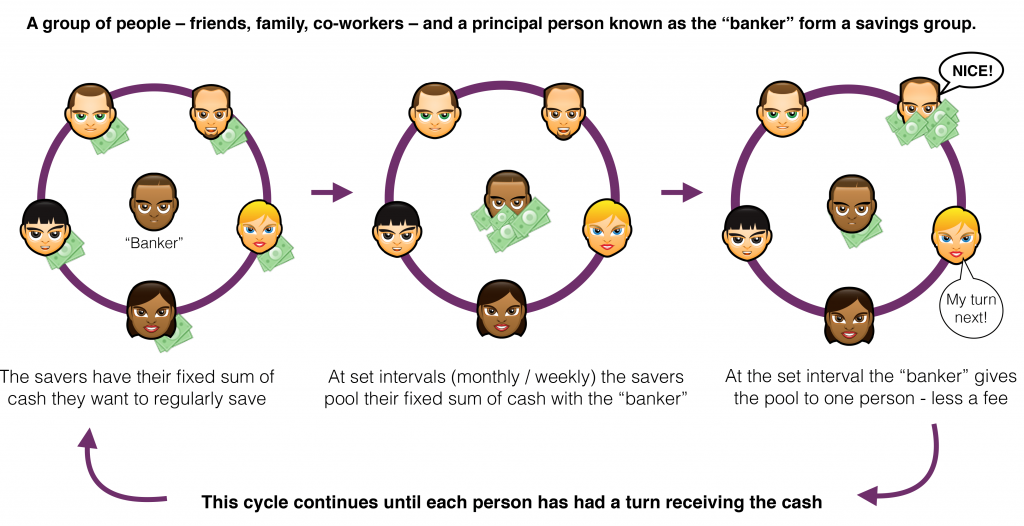

There are some variations in method and terminology, but generally it works like this: a group of people – typically friends & family – come together and agree to submit a fixed amount (the “hand”) every week or month to a central pot. The person managing this central pot (the “banker”) will then arrange for one person in the group to receive all the cash in the central pot (the “draw”). The banker may also receive a small fee for their troubles. And next week or month the process happens again, until each person has had their turn to receive the pooled funds.

But, WHY does this system work?

One of the first questions many people ask when they learn about this system for the first time is “why don’t people run off with the money as soon as they get their early payout?” – so cynical! Well, peer responsibility and social accountability are powerful drivers that has meant that this system has endured for decades. You do not want to be the one to let down your friends or family (or, as in some parts of the world, your community or village). You also want to feel the sense of satisfaction that comes from knowing you have helped people close to you whilst achieving your own personal financial goals. And so you are inherently genuinely committed to make it work by maintaining your obligations to the group. In very rare occasions from the past, those who have deliberately deceived and stolen from an offline savings group have become social pariahs. And in this age of social media, news travels fast – and in some cases so do hands, and you don’t want to catch them.

The Pardna App

We have built Pardna App to make it easy to save with those you personally know and trust; your close friends and family. The people who you would happily lend to in any circumstance anyway (and do not mind taking a loan from), knowing full well the loan would be paid back.

We have developed Pardna App to allow our users to conduct the saving and money generation activities they are used to doing offline, but via a mobile app and in a more efficient, modern and fun way. And perhaps more importantly, we want to introduce new people to this way of saving and generating money. Our mission is to help everyone achieve their financial goals and change mindsets in regard to personal finance.

Future updates to Pardna App will make it easy to safely and securely save and lend with those outside of your personal circles, and automate the process even further. A lot more is coming!

Download Pardna App now!